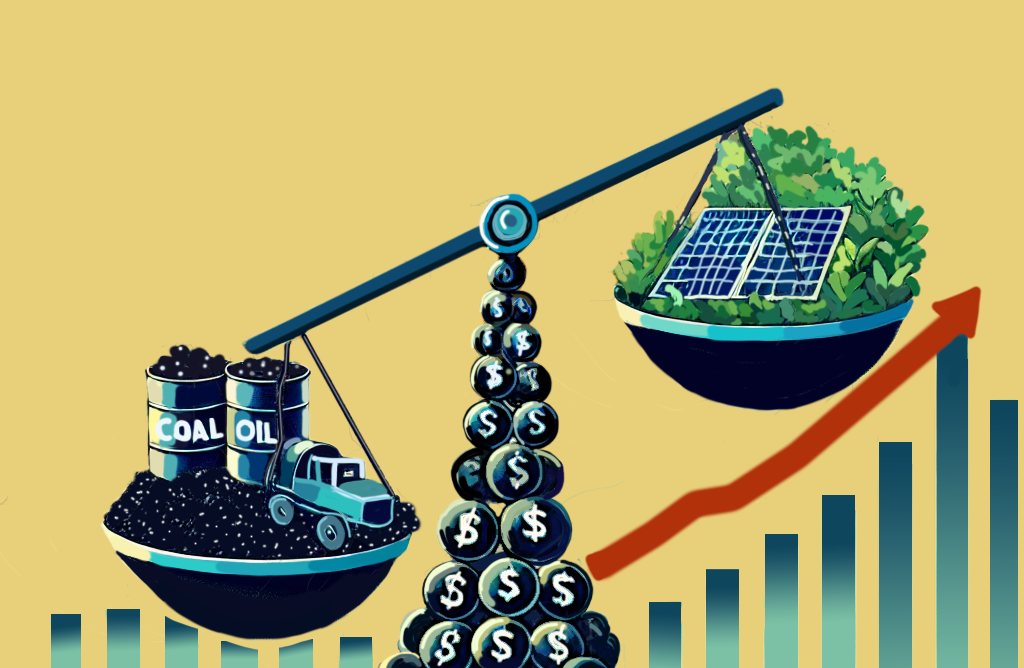

In a significant turn of events in 2022, global investments in renewable energies have surpassed those in oil and gas extraction for the first time. According to Rystad Energy, renewable investments hit $494 billion, outpacing the $446 billion allocated to oil and gas. This shift indicates a growing confidence among banks and investment firms in the future of clean energy.

However, the transition isn’t without its challenges. Major banks, including U.S. giants like JPMorgan Chase, Citibank, Wells Fargo, and Bank of America, still invest heavily in coal, oil, and gas, making up about 80 percent of their total energy portfolios. Despite this, there’s a noticeable trend of public and university pension funds divesting from fossil fuels, causing concern among traditional energy financiers who criticize this move as “woke capitalism.”

This anxiety among fossil fuel backers is understandable, as forecasts from the International Energy Agency suggest that global demand for fossil fuels may peak within the next decade. With the risk of fossil fuel investments becoming stranded assets, more investors are choosing renewables, pointing to a major economic shift that’s gaining momentum. Expect to see more developments in this area as the market adjusts to the realities of a changing energy landscape.

References:

Rystad Energy. (2022). Renewable projects payback time drops to under a year in some places – capital investments shoot up. https://www.rystadenergy.com/news/renewable-projects-payback-time-drops-to-under-a-year-in-some-places-capital-inve

The views and opinions expressed are those of the authors and do not necessarily reflect nor represent the Earth Chronicles and its editorial board.